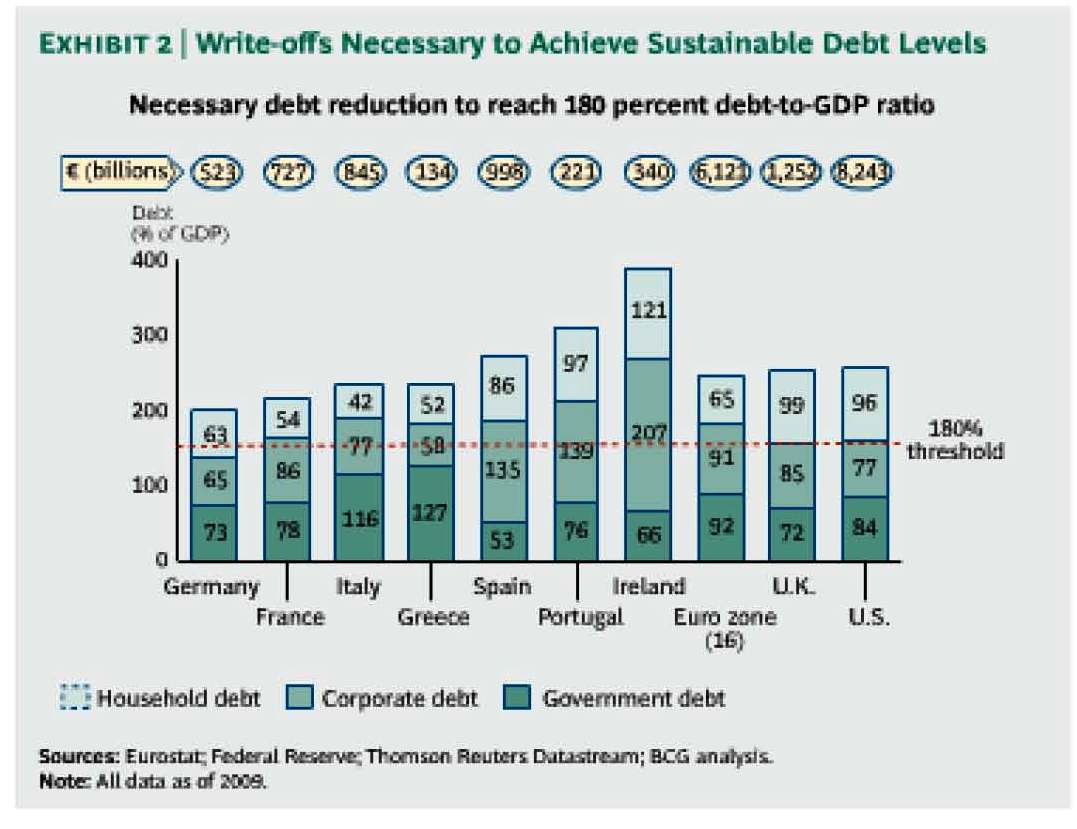

The debts of the countries and private sector have reached in present day extreme, and in regard to existing economic growth, unsustainable figures. The total debt of countries and the reduction which is required to achieve sustainable debt level of 180% of GDP (180% arises from the stable debt level in which households, state and private sector have 60% each, at the interest of 5% and the nominal growth of economy of 3%).

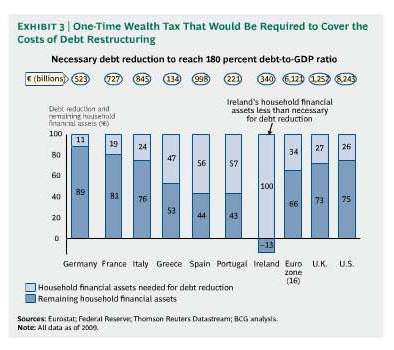

The debt reduction needed for achieving the level of 180% of GDP in % of financial assets of the household of that country.

Source: The Boston Consulting Group: Back to Mesopotamia? Sep2011

The debt crisis leads to the situation when some countries of EMU are at the edge of going bankrupt. Nowadays it is not possible to find any painless solution. One day comes to the deficits reduction and rise of debts. The price for this would be the decline of living standard but as soon the problem is going to be solved as lower the costs for its solving would be. To solve the debt crisis is required:

- Restructurization of debts of problematic countries (Greece, Portugal, Irish banks´ debt)

- Elimination of insolvent financial institutions in fastened bankrupting process and assets auctions, to guarantee the deposits within existing deposit guarantee with assistance of ECB, to recapitalize from the national resources of systematically important banks and reprivatize

- Fundamentally consolidate the public finances of the Eurozone countries

- Reform bank sector and separate deposit (100% of reserves) and investment banking, and prevent development of similar crises in the future

- Reform the functioning of Eurosystem, to make differences between bond risk of individual countries, to limit production of money in the system, to connect euro to a commodity or fully privatize production of money

- For common functioning of a monetary union is not needed a fiscal union. Historically, the whole world was a monetary union – it used gold as a means of payment. To secure not to have unbalances is needed only a credit promise that debts of one country stays as a problem within this country, and there is a real threat of going bankrupt – to punish irresponsible creditors.

It is not rhetoric that too big debt is not possible to solve by the other debt, it is a fact. The fact which, besides others, says also Bill Gross, CEO of the biggest bond fund in the world - PIMCO. The helping mechanism of EU (Euroval) represents this effort. Countries which have problems with high debt themselves should lend to countries in even bigger debt. The guarantees of the countries to other countries threaten their own rating (Italy, France). The existence of EFSF and its use reduces tension of private debts and paradoxically ease the further indebting. EU has a problem to find a mechanism by which it would force the countries using its help to undertake painful measures. Greece does not privatize, Italy does not save enough. At the same time, the effort to put a political pressure from abroad leads to rise of nationalistic passions within the union.

Recommended bibliography

Bill Gross about the fact that debt cannot be solved by another debt

http://www.pimco.com/EN/Insights/Pages/Pennies-from-Heaven.aspx

British draft of a banking system

http://blog.mises.org/13868/british-proposal-for-banking-reform-fractional-reserve-banking-versus-deposits-and-loans-2/

INESS Policy Note: The opinion of INESS to rising EFSF and extension of its competences

http://www.iness.sk/themes/Milo/texty/INESS%20Policy%20Note%202011%20Oktober.pdf

Comments

31 comment(s). Display all comments.

ty si musis riesit riadny komplex menejcennosti ked sa vsade prezentujes ako velky vedator, ktory prave objavil svet. Ked nevies ako zaujat a pritiahnut na seba a tvoja uzasnu reformu pozornost tak chod s tym do telky a vsetkym povedz o tom tvojom prevratnom objave, ktory vyriesu globalnu krizu, hlad, biedu a utrpenie na celom svet…. Ale tu s tym prosim ta neotravuj a nezatazuj ludi citanim tych tvojich nezmyslov…..a to ze su to nezmysly pochopia prave ti viac chapajuci

Teraz som zistil, ze zvysenie zivotnej urovne na Slovensku nenaraza len na nevolu politikov, ale aj na samotnych Slovakov, ktori nemaju dostatocny nadhlad nad trhovym hospodarstvom. Da sa pomahat Slovakom, ktori nie su dostatocne inteligentni, aby tito pomoc pochopili?

REALIZÁCIA PROJEKTU JEDNOTNEJ ODVODOVEJ DANE

http://amaterskenoviny.comule.com/realizacia.php

ok takze uz no comment….ale nie kvoli tomu ze by som si myslel ze jak si ma zotrel ale kvoli tomu ze si myslim ze to uz nema zmysel sa s tebou o tom bavit. Takze pekne sviatky ti zelam.

Trochu divne, ze urazas a kritizujes nieco, co sa ti nechce citat, ale dobre. Ty jednoducho nechces pochopit to, ze v sucasnosti je praca zdanena 41% a zisk len 19%. Ako nazves hruby zisk spolu so mzdovymi nakladmi? Ja som si to minule nazval obrat, aj ked obrat znamena, nieco ine. Finta je v tom, ze firma, ktora nezaznamena ziadny zisk a cely svoj obrat minie na platy zamestnancov musi statu dat 41%. Ale firma, ktora len polovicu obratu da zamestnancom a polovicu si necha ako zisk tak ta zaplati statu len 30% z obratu. A v tom je velka nespravodlivost sucasneho systemu.

A teraz k tvojim bodom:

1. Priznam sa, ze som ta poplietol. Totis reforma sposobi dva druhy presunu financii v hospodarstve:

a) medzi firmami - tie s velky ziskom (velky zisk znamena, ze je vyrazne vacsi ako su mzdove naklady) daju cast penazi reformou tym chudobnejsim firmam a to konkretne ich zamestnancom, ktorym sa zvysia platy s tym, ze cisty zisk tajto chudobnej firmy sa nezmeni.

b) presun penazi v ramci jednej firmy - a to konkretne usetrene odvody zamestnavatelov za zamestnancov by sa presunuli do ich hrubeho zisku a to je to co si spominal, ze by si mohli firmy tento vyssi zisk lahko schovat do nakladov. Ale po prve nemali by motivaciu pretoze, ich cisty zisk by sa nezmenil ani vyssou danou, po druhe mali by len dve moznosti ako to urobit, bud nekalim sposobom a to by mal odhalit danovy urad alebo legalnym sposobom napriklad peniaze investovat, co by bolo len pre hospodarstvo plusom. A teraz priklad v Peugeote, ktory ma 1,8mld sk mzdove naklady by museli takto presunut 380 mil sk do zisku, ktory je dnes 2,2mld sk. Myslis ze by sa firme Peugeot podarilo sumu 380 mil sk schovat do nakladov? Keby sa to dalo, tak by tato firma nevykazovala zisk 2,2mld sk. A prave o taketo firmy ide, male firmy nie su az take